$AMBO is a Clown Car of Lies, Incompetence, and Poor Governance Speeding toward a Second Delisting

Apparent exaggerations regarding relationships with U.S. big tech combine with rotting prospects in America and at home to put this Chinese stock pump on a highway back off the NYSE

Ambow Education Holding Ltd ($AMBO) is a Beijing headquartered, Cayman Islands-registered for-profit education services company. Ambow bills itself as an innovative, leading provider of K-12 programs, career-oriented tutoring, and more for the Chinese market, and it recently expanded its scope with the acquisition of two accredited for-profit colleges in the U.S.

In reality, Ambow appears to be little more than a multi-million dollar slop bucket of fraud and failure. The company was delisted from NYSE in 2014 after a court-ordered 2013 liquidation following “alleged sham transactions and kickbacks.” It was allowed to re-list in 2018, but since then founder/CEO Jin Huang—who refused to resign after steering the company into its 2014 delisting and who now controls a supermajority of the company’s voting shares—seems to have doubled down on a strategy of misdirection and a general top-down tendency toward incompetence.

Unfortunately for Huang, though, the bottom appears to be falling out under Ambow’s U.S. investments just as massive domestic headwinds in China have gathered. Time is running out, and the company’s misconduct appears to run deeper than previously known.

Our investigation found the following:

Ambow appears to have misleadingly overstated its relationships with major American tech companies including Amazon, Cisco, and Adobe.

Ambow has gotten into the habit of publishing press releases announcing “Strategic Cooperation” or a “Strategic Partnership” with major U.S.-based tech firms, deploying language that appears tailored to invoke the image of active, formal, bilateral collaboration between big-name companies and Ambow.

But in many cases, there seems to be scant evidence that these deals exist outside of Ambow’s PR shop, or that they amount to little more than Ambow creating a for-profit wrapper around resources consumers could find for free or for cheap online—possibly without the “partner” company even knowing.

Someone needs to do a research report on PR Newswire. Get on it.

Consider the following examples:

Amazon

In September 2020, an Ambow press release touted that the company had “expanded its strategic partnership with Amazon” in “Digital Professional Education, Training and Certification.” Within this partnership, Ambow would purportedly offer AWS training and certification courses through its “Huanyujun Education Hub,” which the company described as “a next-generation online-to-offline education SaaS platform” consisting of “education institutes/teachers, students and shared class rooms,” that also “integrates online resources (panoramic live streaming) with off-line resources (physical classrooms and teachers).” (If that sounds like it’s just a bunch of classrooms with TVs and webcams, then you see where this is going) The stock shot up on the apparent $AMZN cosign.

The use of the word “expanded” is the first crack in this facade. The September 2020 press release states, “In 2018, Ambow and Amazon signed an international cooperation agreement related to Amazon Web Services (AWS) training and certification, agreeing to jointly build a cloud skills training base.” That 2018 “signed” agreement would have been a huge deal for a company trying at the time to rise from the ashes of fraud, and would have likely garnered some mention by the company and/or Amazon.

But we have so far found no mention of this phantom 2018 agreement anywhere in the company’s filings or online—including in Ambow’s PR shop—until after September 2020.

The “expansion” announced in September 2020 itself seems equally flimsy, and it points to what may be really going on here. In its Q3 2020 earnings announcement, Ambow management stated not that it had entered into an accord with Jassy (then Bezos) & co, but that it had, “gradually started rolling out Amazon Web Services (AWS) . . . training courses on the Huanyujun Education Hub.”

Note that Amazon’s AWS training and certification courses are largely freely available online. We have so far not found concrete evidence that the so-called expanded strategic partnership announced that September amounts to more than creating a paid classroom environment where students could take these already mostly free courses, and it is unclear whether Amazon is actually involved at all—let alone that they “signed” anything. (Amazon did not respond to a request for comment)

Undeterred, Ambow dropped another press release in April 2021 stating, “Ambow Education Expands Partnership with Amazon in Artificial Intelligence Training for Teachers.” The stock jumped by a third. But we have found no evidence that this second expanded partnership was anything but a headline, and Ambow dropped any mention of Amazon and of the Huanyujun Education Hub by the time it published its FY 2021 financial filings after touting both in its FY 2020 filings.

It’s entirely possible that Ambow hosts or hosted paid-for classroom experiences where students get or got hand-holding in often free online AWS courses. It’s also possible that Ambow has some variety of business or other relationship with Amazon. But there is little to prove that whatever is going on here is anything more than a campaign of press releases—let alone that it reflects a close-knit “strategic partnership” with Amazon along the lines of the narrative that Ambow’s PR team appears to be spinning. And even if a partnership between the firms did once exist, it is now unclear whether they have been discontinued or expired.

Perhaps that’s why the stock has continued cratering even after these announcements, with only brief sugar highs prevailing after each press release. But even if short-lived, those price jumps may represent fraud in American public markets.

Cisco

In November 2020, using language much like it did for Amazon, Ambow published a press release stating “Ambow Education Enters Strategic Partnership with Cisco for International Career Education, Training and Certification.” Under the partnership, Ambow and Cisco would allegedly “provide high-quality online courses as well as authoritative certification of IT and the Internet, for college students and industry professionals around the world.” As in the Amazon case, this training would supposedly happen on the Huanyujun Education Hub. Ambow stock briefly shot up on the news.

It is unclear what this partnership ever consisted of or whether the two firms were nearly as intertwined as the press release’s rhetoric implied. Searches from the day after the November press release on reveal little more than that Bay State College, the American for-profit college that Ambow recently purchased, used Cisco technology to help its post-COVID plans to return to in-person classes.

As with Amazon, neither Cisco nor the Huanyujun Education Hub were ultimately mentioned at all in Ambow’s 2021 report, even after being touted in its FY 2020 filing.

Instead, there is evidence that—as above—Ambow may have just been putting misleading PR gloss on a program that amounted to little more than making people pay for free online courses. In particular, Ambow specified in its November press release that its partnership with Cisco centered around students gaining access to the Cisco Networking Academy. But Cisco Networking Academy states clearly online that its programs are free and widely available.

It does appear that Cisco and Ambow partnered in 2007 and 2009 on workforce training initiatives, but—as in the present case—it’s unclear where it all went. And at least in those cases there’s evidence Cisco knew about it. Ambow hasn’t shown up in Cisco’s filings since 2013, and it does not appear that Cisco has acknowledged or confirmed the specific partnership described in the November 2020 press release. (Cisco did not respond to a request for comment)

In any case, as with Amazon, even if Cisco does or did in fact have a relationship wherein it allows Ambow to provide paid pathways to its free classes, that hardly amounts to the meeting of the minds that Ambow depicted in its November 2020 press release. There, Ambow claimed “the two companies will cooperate on designing vocational education curriculums, building ‘smart classrooms’ and strengthening innovation and entrepreneurship.” But that ain’t this, chief.

Adobe

In a June 2021 press release, Ambow stated it had formed a “Strategic Cooperation with Adobe Authorized Training Centre in China (AATC) for Digital Creative Talents Training and Relevant Certification Services.” Within that arrangement, the two companies would “aim to carry out in-depth cooperation in international talent training and certification services, providing international certification services for Chinese students, and helping students improve their competitiveness and professional skills in the workplace.” [emphasis added]

It is not clear whether this partnership ever actually existed as described or at the level of intimacy that Ambow clearly pointed to in this press release. Adobe does not appear to have acknowledged any partnership with Ambow, nor does Adobe appear to display Ambow on its list of Authorized Creative Cloud Training Partners.

Instead, as in the cases above, Ambow may simply be offering to let students pay it for courses they could get elsewhere and labeling that conduct a glossy multinational “partnership.”

In particular, in its June 2021 press release, Ambow described the training its Adobe partnership would involve by pointing to the Adobe Certified Professional credential, stating “Adobe Certified Professional (ACP) is recognized as a comprehensive, scientific, rigorous and efficient assessment system launched by Adobe Company for Adobe software learners and users around the world, including Adobe Photoshop Certification, Adobe Illustrator Certification, Adobe InDesign Certification, Adobe Animate Certification, etc.”

But ACP is already available directly through Adobe, and while the courses involved aren’t free, one need not use Ambow’s services to access them.

Plus, even if Ambow had Adobe’s blessing to offer a paid pathway to ACP, that hardly amounts to the “in-depth,” far-reaching form of collaborative partnership that Ambow depicted in its June 2021 press release. Perhaps that’s why Ambow dropped all mention of Adobe from its FY 2021 annual report after bragging about its partnership with the company in its Q1 2021 quarterly filing.

This does not appear to be a case of simple business puffery and PR storytelling

In each of these cases, Ambow appears to have misled the public into thinking it had substantively joined ranks with some of the biggest names in tech when the reality may have been far less impressive. Indeed, even if Ambow had at some point entered a variety of deal with Amazon, Cisco, and/or Adobe regarding course offerings, a huge credibility gap has clearly emerged between the nature of those relationships as advertised and as realized.

Where Ambow seems to have described being in a bear hug with these companies, the reality appears to have barely been a handshake.

It now falls on Ambow to prove that it didn’t cross the line between corporate puffery and outright misrepresentation—because right now, it seems to have leaped over that boundary headfirst.

Unfortunately, Ambow’s credibility gap is only made wider by the number of puzzling, buzzword-laden missives that it also dropped through PR channels over the past three years. This includes press releases touting the adoption of blockchain technology, a commitment to “AI-assisted solutions,” and a partnership “to Establish World-Class AI and Humanoid Robotics Teaching Platform” with a company that appears to exist only in Ambow’s press release.

All signs point to a business strategy based more on PR—and possibly on outright deception—than on an interest in product and execution.

Ambow’s U.S. investments are falling apart under failing execution and gross mismanagement.

Ambow is the proud owner of two accredited for-profit U.S. colleges, Bay State College in Boston and the NewSchool of Architecture and Design in San Diego. It bought Bay State in 2017 and the NewSchool in 2020.

The pace at which Ambow appears to have run these schools into the ground is startling.

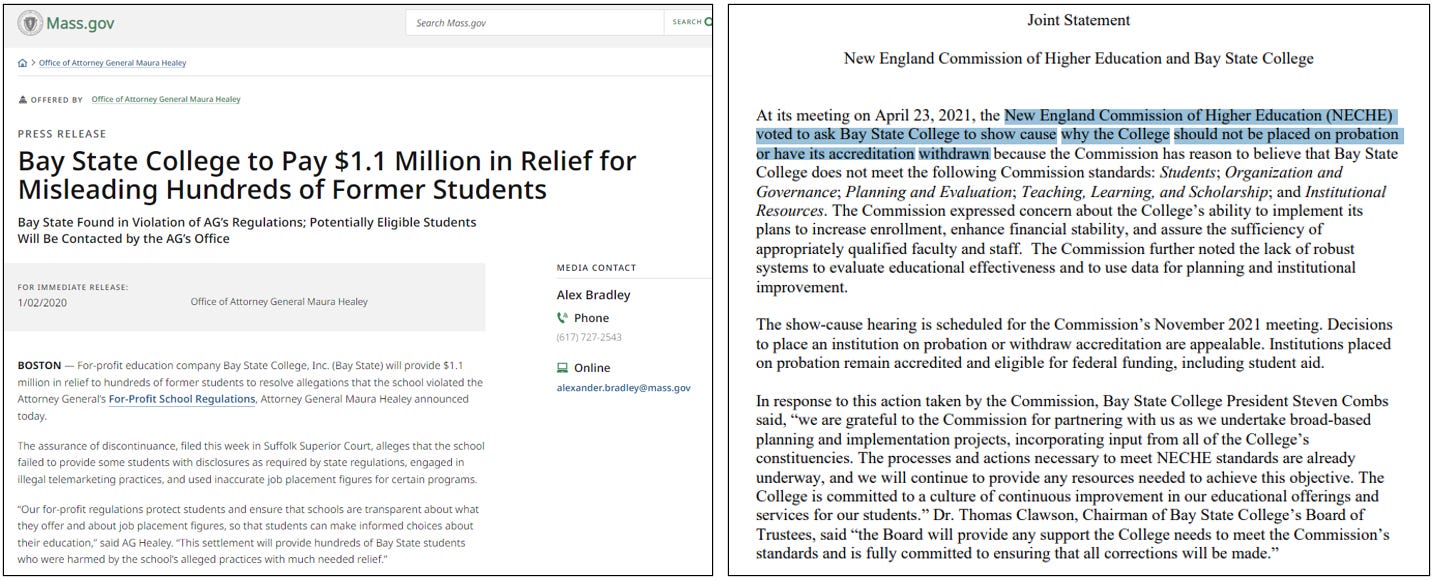

For starters, Bay State settled with Massachusetts Attorney General Maura Healey in 2020 “for Misleading Hundreds of Former Students,” including allegations that “the school failed to provide some students with disclosures as required by state regulations, engaged in illegal telemarketing practices, and used inaccurate job placement figures for certain programs.” Meanwhile, enrollment at the school continues to slide, dropping from ~1,700 students in 2012 to fewer than 700 even before COVID.

Now, Bay State faces the possible loss of its accreditation and, therefore, its access to the federal higher education grant and loan programs that it relies on to survive. In particular, in May 2021 Bay State’s accreditor, the New England Commission of Higher Education (NECHE), “voted to ask Bay State College to show cause why the College should not be placed on probation or have its accreditation withdrawn” because of “concern about the College’s ability to implement its plans to increase enrollment, enhance financial stability, and assure the sufficiency of appropriately qualified faculty and staff. The Commission further noted the lack of robust systems to evaluate educational effectiveness and to use data for planning and institutional improvement.”

NECHE held a hearing for Bay State in November 2021 at which it decided to “request . . . additional information” for consideration at its April 2022 meeting. Results from that meeting are pending, and sanctions could come in many unsavory forms. We’ll be watching for where this goes next.

More like Bad State, more like Oy Vey State, we’ll show ourselves the door.

The NewSchool, meanwhile, is facing its own uphill battles. Enrollment has fallen below 500 students, and California’s Bureau of Private Postsecondary Education, which regulates for-profit colleges in the Golden State, fined the institution in January for failing to meet certain legally mandated filing requirements. Perhaps foreshadowing what may be to come, the missed filing in question had to do with a state-level fund for students who are harmed when schools unexpectedly close.

They say you get points for just submitting your name on the form . . .

In addition, the Higher Education Inquirer reports that while Ambow claims it can achieve operating efficiencies by sharing back-office functions across its two schools, doing so may violate the terms of the schools’ respective accreditations. As the Higher Education Inquirer describes it, the issue is that while the schools are separated by a continent, their accreditations—as is the case for most schools—are regional.

So who is Ambow calling in to right the ship? That would be Kevin Derrivan, the man whom Ambow announced with fanfare as “regional chief financial officer” for US operations in March 2021.

Derrivan most recently worked at Sattler College, a Christian college opened in 2018 that is “entirely funded” by a wealthy investment manager whose goal was to launch a school where “safe spaces” would be banned. Sattler does not participate in the federal student aid programs that Ambow and most other colleges in the U.S. rely on.

It’s not clear what Derrivan’s plan is to turn things around. We imagine it involves praying.

Ambow’s American holdings are not its largest revenue or profit driver, but they play a substantial role in the firm’s finances. And in light of the speed at which the company needs to figure out a revival plan to avoid—as discussed further down—being delisted, trouble in this corner of the business could prove particularly pesky.

Ambow is still reeling under a Chinese crackdown on for-profit education, and the company has only moved closer into the state’s mercurial orbit while grasping for a path forward.

Ambow’s stock began its current tumble in late July 2021, when China’s government announced a sweeping crackdown on its massive for-profit online education sector. This move came amid broader steps in the latter half of 2021 by China’s government to assert its role in private industry—often at the multi-billion dollar expense of investors in the US and abroad—and its actions in the education space were framed specifically around reducing childhood overwork. (You know, given their opposition to . . . child labor . . . )

Ambow brushed these changes aside in a press release, stating it “does not expect its operations to be materially affected” by the government’s move, and that its “main business focus remains on technology driven educational and career enhancement services and patented technology products.”

But then a funny thing happened: Ambow began announcing through its press channel that it had gotten approval from the Chinese Ministry of Education for it to participate in projects facilitating collaboration between universities and industry. That isn’t bad per se, but it points to a troublesome trend: with the government cracking down on K-12, Ambow is responding by doubling down on state-sanctioned pathways to survival. That may be fine for now, but as many Chinese companies more focused on K-12 recently learned, that reality can change on a dime.

In its FY 2021 annual report, Ambow disclosed for the first time as a risk factor that the People’s Republic of China (PRC) government “exerts substantial influence over the manner in which we conduct our business activities,” warning that “[t]he PRC government may also intervene or influence our operations at any time, which could result in a material change in our operations and our ordinary shares could decline in value or become worthless.” [emphasis added]

I mean, we would argue it’s already worthless.

Ambow is admitting that it is situated in the crosshairs of a sector that has already seen a government crackdown, and in a context where that government seems more intent than ever on reminding the public that it can turn for-profit companies into nonprofits, arms of the government, or memories with the snap of a finger. Do you want to be the one pricing that risk?

(And that’s all to say nothing of the impending fight over U.S. oversight of accounting practices by Chinese companies, of which Ambow isn’t a direct target but could nevertheless readily become collateral damage.)

Fool me twice . . .

Ambow’s stock has been below the $1 threshold for NYSE listing since late December 2021. It has only a few weeks left to rise and stay two-thirds above its current price ($0.60ish), or it’ll be delisted—again.

You tell us—you’ve read up to here, what do you call the odds it pulls through?

Or better yet—how much more can it fall before a second delist, and who will pick up the alpha along the way?

After all, it’s just a question—and it sure ain’t investment advice.

Appendix: Some additional, wild articles we didn’t find space for on the wacky history preceding Ambow’s last delisting [emphasis added throughout]:

Reuters: Ambow setback teaches Baring a lesson in China investing

“Baring Asia Private Equity. . . is now sitting on an $43 million paper loss from a $57 million investment in New York Stock Exchange-listed Ambow Education Holdings Ltd.”

“Court-appointed partners of KPMG, the global consultancy, arrived at Ambow’s Beijing offices on June 13 to take over management and complete an 11-month investigation into allegations of sham transactions and kickbacks at the schools and training firm.”

“In April 2012, Ambow said it was unable to file its 2011 annual report on time. Two weeks later, it announced it was making adjustments to previously released unaudited financial results. . . . Two months later, a former Ambow employee alleged its 52.3 million yuan ($8.52 million) cash and stock purchase of a Changsha-based school in 2008 was a fraud, with 25 million yuan returning to the company through the issuance of fake software invoices, according to the combined civil complaint.”

“Avenue, the company’s biggest outside shareholder, has accused Huang of blocking the inquiry into those allegations. . . . When Huang refused to step aside at an extraordinary board meeting, three of Ambow’s four independent directors resigned. . . .”

DealBook: Private Equity Capitalizes on Chinese Firms’ Depressed Shares

“Rapid downfalls have not been uncommon among Chinese companies listed in the United States in recent years, . . . But Ambow’s situation stands out. ‘Perhaps no company ever transited as quickly from a private equity firm’s sought-after takeover target to being liquidated[.]’”

“On March 18, three of Ambow’s four independent directors resigned. On March 22, the law firm Fenwick & West resigned after nine months of leading the investigation into possible financial misconduct. That same day, the Chinese affiliate of PricewaterhouseCoopers, also known as PwC, resigned as Ambow’s auditor.”

Eclipse Research is not an investment advisor and anything it publishes is not investment advice. Any assertions that Eclipse Research makes represent our opinions. All information Eclipse Research provides is accurate to the best of our knowledge, but Eclipse Research expressly disclaims making any express or implied warranties regarding the accuracy of the representations it makes for any purpose or usage. Nothing that Eclipse Research publishes may be considered an offer or solicitation to purchase or sell products or services, and everything Eclipse Research publishes should be considered opinions and investment ideas that are not meant to lead to any private solicitation of a product or service. We are not liable or responsible for any damage or lost opportunities resulting from the use of any information or opinions we publish. Investing is a risky activity, and anyone considering any investment should consult formally with professional financial, legal, and tax advisors before making an investment.

More mumbo-jumbo in an announcement today. Looks like the PR hiatus is over. https://finance.yahoo.com/news/ambows-one-stop-integrated-intelligent-123000494.html

Have an update. https://www.highereducationinquirer.org/2024/02/ambow-education-continues-to-school.html